Introducing Merlin: Your Partner for Smarter Financial Decisions

A financial solution to provide the insights and tools you need to make smarter, more strategic decisions.

What is Merlin?

Merlin is a cutting-edge financial modeling and planning solution tailored to meet businesses' unique challenges. It goes beyond traditional financial tools by analyzing your current financial situation, projecting future scenarios, and providing actionable strategies to help you achieve your goals. Think of it as your CFO assistant, ready to guide you toward better cash flow management, cost optimization, and long-term growth.

Why We Created Merlin

At its core, Merlin was built to solve real-world financial problems. We noticed a pattern across businesses of all sizes: uncertainty about cash flow, difficulty planning for the future, and the constant stress of making the right decisions. Business owners and leaders often lack the tools to see the bigger picture or to react quickly to changing conditions.

We created Merlin to address these pain points. It's more than a tool; it's a solution that empowers businesses to manage their finances confidently.

What Can Merlin Do for Your Business?

Here's how Merlin helps businesses like yours:

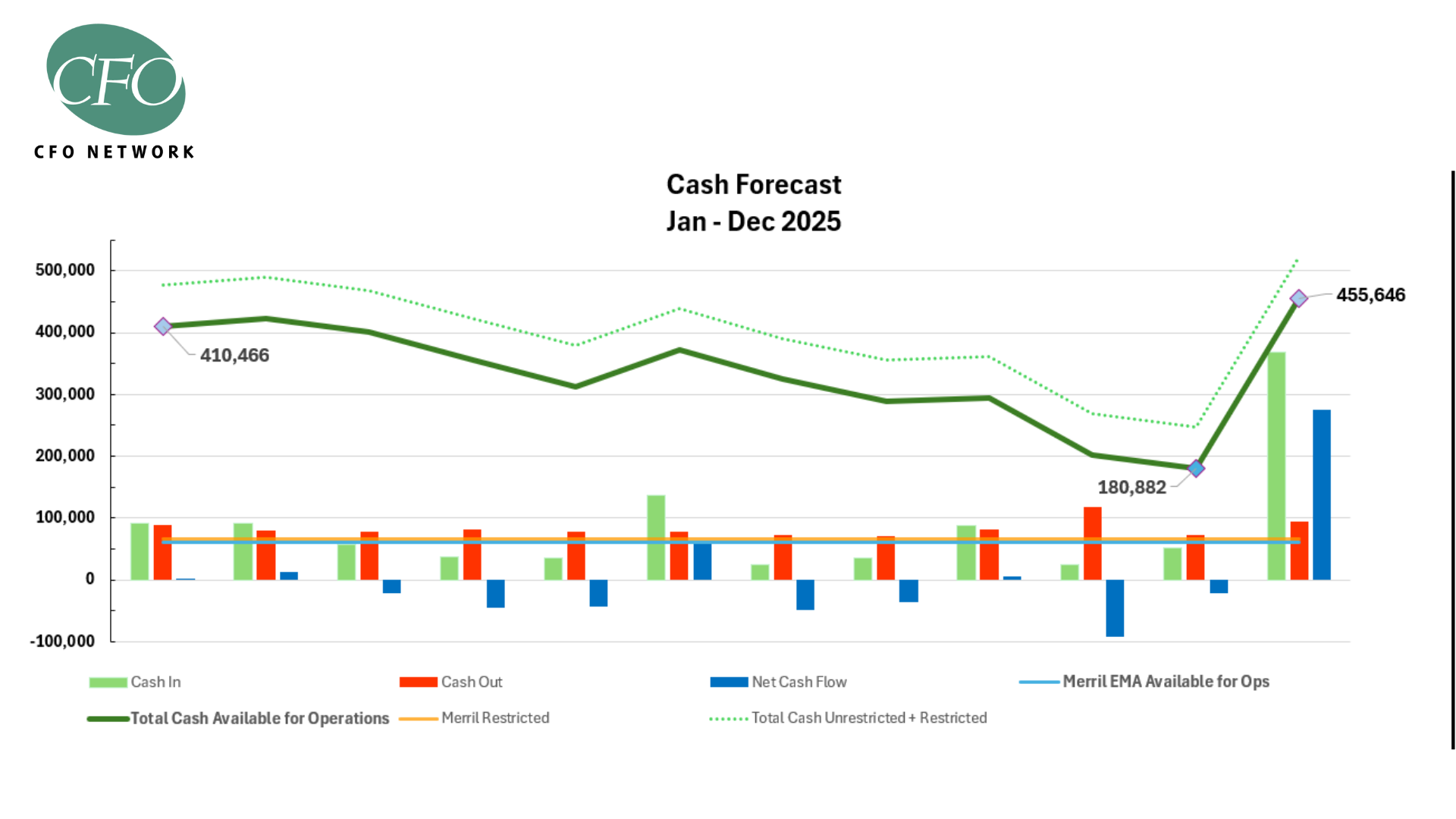

- Cash Flow Clarity

- Struggling to manage cash flow? Merlin gives you a clear picture of your current cash position and enables you to understand how it will evolve under different circumstances. Whether you're managing late payments, evaluating expenses, or planning for growth, Merlin provides the insights you need to stay ahead.

- Scenario Planning Made Simple

- What happens if sales are lower than expected? What if you hire more staff? With Merlin, you can easily model these scenarios and see how they'll impact your bottom line. This allows you to make proactive, informed decisions rather than reacting to surprises.

- Strategic Decision Support

- Should you cut costs, invest in growth, or seek funding? Merlin helps you weigh your options and choose the best path forward, minimizing financial risks and maximizing opportunities.

- Funding Insights

- Merlin analyzes the funding needs of businesses looking to raise capital and helps you strike the perfect balance between securing necessary cash and maintaining ownership equity.

Ready to Transform Your Financial Strategy?

Managing your finances shouldn't be a guessing game. With Merlin, you'll gain the clarity, confidence, and control you need to make decisions that drive your business forward.

Are you ready to take the next step? Discover how Merlin can help your business thrive. Contact us today for a free demo, and let's start building a brighter financial future together.